What do you do should you go to your native pharmacy to fill your month-to-month insulin or different diabetes remedy prescription, solely to search out that your well being insurer has switched your remedy with out your physician (otherwise you!) understanding?

This apply is named ‘non-medical switching’ and occurs when a well being insurer removes a lined prescription out of your well being plan or strikes it to the next tier in your plan, making your co-payment prohibitively costly. Plans will often do that to economize.

The results of non-medical switching can range from a slight annoyance to extraordinarily unfavourable medical penalties.

On this submit, I’ll clarify why insurance coverage firms generally change your diabetes remedy and the choices you will have for interesting the choice.

Desk of Contents

How do medical health insurance firms determine which medicine to cowl?

In response to Categorical Scripts, medical health insurance firms first have a look at the efficacy of a drug, not essentially the price of a drug, when deciding what to cowl.

Well being plans often have committees made up of physicians and pharmacists who evaluate the data that federal regulators used to approve a drug, along with what number of different, comparable medicine are available on the market, earlier than making a remaining determination.

All well being plans in the USA cowl insulin, it simply is dependent upon what type they’re keen to cowl.

What’s non-medical switching?

Non-medical switching is a typical cost-saving tactic utilized by many medical health insurance plans in the USA.

It occurs when an insurance coverage firm adjustments the phrases of a contract or the price of a drugs for a steady affected person; the “change” isn’t because of medical causes however is usually a less expensive model that the well being insurer has deemed interchangeable with the previous remedy that the affected person was prescribed.

This apply differs from “step remedy” the place a affected person should “fail” on a drug first earlier than the well being plan will cowl a dearer one.

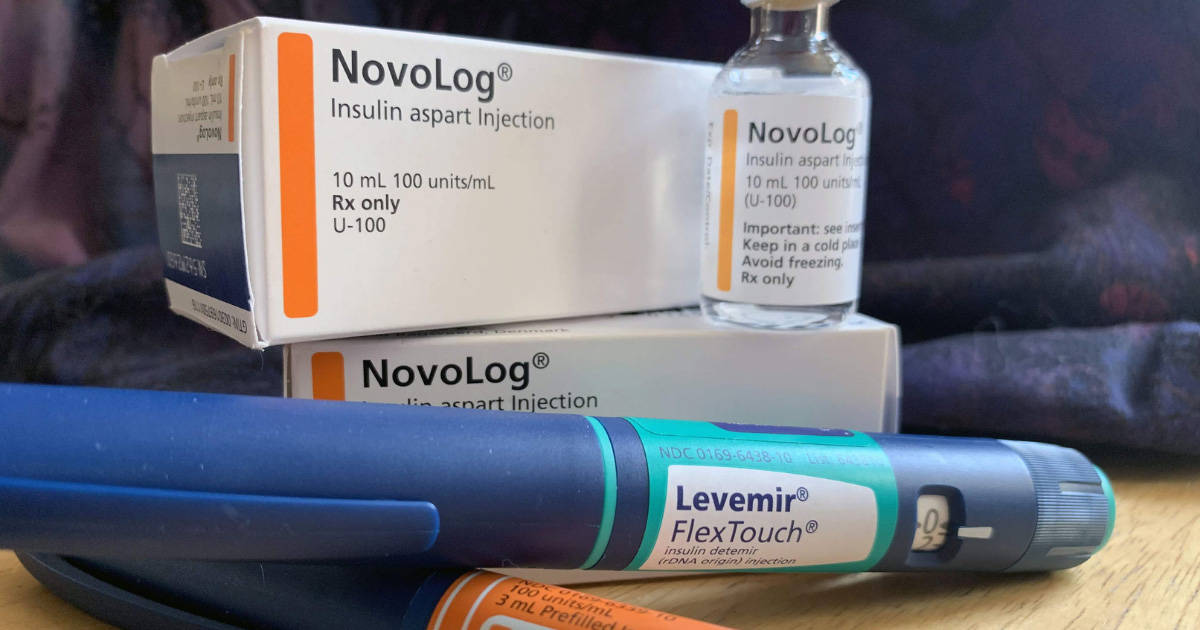

Assume: forcing a affected person with diabetes to make use of an older, human insulin (like R or NPH), and to ultimately have a excessive A1c, earlier than the well being plan will cowl a more moderen, quicker, analog insulin, like Humalog or Novolog.

In response to the U.S. Ache Basis, non-medical switching prices the USA over $100 billion yearly, and it instantly hurts sufferers who’re in any other case steady on their prescription medicines.

Is non-medical switching at all times an issue?

It’s vital to notice that non-medical switching just isn’t at all times a nasty factor.

First, the apply just isn’t quite common, so should you’re newly recognized, don’t fear about this till it truly turns into an issue.

Second, should you’re taking a drugs, however your well being plan switches you to a more moderen model of the identical drug that works even higher, or a drug that works fully interchangeably along with your previous remedy and also you discover no distinction, then there’s no drawback and there’s no purpose to fret.

Non-medical switching is a matter in case your well being plan adjustments your remedy to a different remedy that you just’re unable to take as a result of your well being will endure should you do.

How you can undo non-medical switching

Having your remedy modified final minute, particularly should you’re doing effectively on it, could be extraordinarily irritating. The excellent news is that you just don’t have to just accept these adjustments outright.

There are a number of issues you are able to do to attraction a choice to change your diabetes remedy. Here’s a step-by-step information:

Name your physician

The attraction course of can take time, so instantly notifying your diabetes crew of the adjustments you’ve skilled on the pharmacy counter is essential. Your physician can supply recommendation on tips on how to change your dosing quantities, if relevant.

For those who’re unwilling or unable to make use of the newly prescribed remedy, however your previous remedy is now exceedingly costly, the American Diabetes Affiliation and Past Kind 1 have gathered a wealth of assets for sufferers who need assistance affording their medicines.

Request your previous remedy

For those who’ve been on a selected kind of insulin or remedy for a number of years or extra (on the identical medical health insurance plan), insurers usually received’t change your protection, but it surely does occur.

For those who’re unwilling to attempt the brand new drug, you must instantly name your medical health insurance plan and request your previous remedy.

The well being plan might say that they want a previous authorization (PAR) out of your physician stating that the precise prescription drug they’re requesting is a medical necessity to you, and can’t be used interchangeably with one other, cheaper drug.

A previous authorization request have to be submitted by means of your medical skilled – you can’t submit one by yourself behalf.

Some individuals run into these points a number of occasions a 12 months, for a number of medicines, because the PAR course of is a manner for insurers to chop prices (and keep away from protecting dearer medicine for his or her purchasers).

Have your physician request “99 months” on the prior authorization, so this headache doesn’t turn into an annual occasion.

In a 2018 examine within the Journal of Present Medical Analysis and Opinion, researchers surveyed 451 individuals with kind 2 diabetes about their experiences with non-medical switching.

After their medicines have been switched, one in 5 had been instructed by their physician that their blood glucose ranges have been considerably or a lot worse than they’d been on their earlier remedy.

About 20% additionally needed to examine their blood sugars extra usually than earlier than they switched, which might turn into a bodily, emotional, and monetary burden.

Moreover, practically 1 in 4 stated the non-medical change negatively impacted their psychological well being.

Request a “peer-to-peer” evaluate

In case your well being plan denies your request on your previous remedy again, you possibly can request a peer-to-peer analysis, by which your physician confers with a health care provider from the well being plan to debate why your particular remedy is medically mandatory.

This could generally resolve the issue with out going by means of a prolonged appeals course of.

File an attraction (an inner evaluate)

For those who’re battling the brand new remedy and you can’t afford your previous remedy (by paying the upper co-payments or paying out of pocket), your physician can attraction your insurance coverage firm’s determination by requesting an inner evaluate.

Remember that this can be a prolonged course of and there’s no assure of success. Listed below are the steps in submitting an insurance coverage attraction:

- Collect the denial letter from the earlier makes an attempt to get your previous remedy again. That is generally referred to as a willpower letter.

- Evaluation your Clarification of Advantages doc, to verify the denial wasn’t made in error. You may at all times name your insurer’s customer support line to get extra details about the unique denial.

- Name your physician’s workplace to allow them to know you’re requesting an attraction. They will help you with writing an attraction letter in your behalf, and even assist you fill out the right kinds.

- Preserve observe of your blood glucose knowledge for a number of weeks. Sure, we’re bringing out the old-school logbook (or a diabetes app). This can be utilized as proof in your attraction that the brand new drug is inflicting unfavourable penalties on your diabetes management.

Chris Plourde, who lives with kind 1 diabetes and has skilled non-medical switching, says, “paperwork to substantiate your declare that the brand new remedy isn’t a very good match is essential. For those who can present documentation that the unique drug labored, often insurance coverage firms can be okay with it,” she says.

“However you want a whole lot of documentation proving that you just want it. For those who get switched, write down your blood glucose readings, write down how the brand new remedy makes you’re feeling, write down all of the adjustments you discover.”

File an exterior evaluate

Typically inner evaluations don’t work out for the affected person, and the insurance coverage firm sticks with its authentic determination. Don’t fear; you possibly can request extra inner evaluations, and even request an exterior evaluate.

Conducting an exterior evaluate signifies that you’ll herald an unbiased third social gathering who will determine the matter. Your well being plan’s remaining denial letter will embody info on tips on how to file for an exterior evaluate and the timeframe inside which you have to achieve this (often 60 days from the ultimate denial).

After a 3rd social gathering has decided in an exterior evaluate, the medical health insurance plan is legally certain to just accept it.

What are individuals doing about this?

Fortunately, many affected person advocacy organizations are considering fixing this drawback to forestall it from occurring to extra individuals. The Preserve my Rx marketing campaign is gathering grassroots help to unfold consciousness about this apply.

Moreover, many states are beginning to ban non-medical switching or restrict the apply.

In the previous few years, California and Nevada have adopted such legal guidelines. States like Florida and Tennessee have additionally thought of comparable laws, and Massachusetts has fashioned a fee to research the thought. Colorado has banned the apply for some medicine.

Nonetheless you select to become involved, your well being and diabetes administration ought to by no means be compromised for a well being plan’s backside greenback.